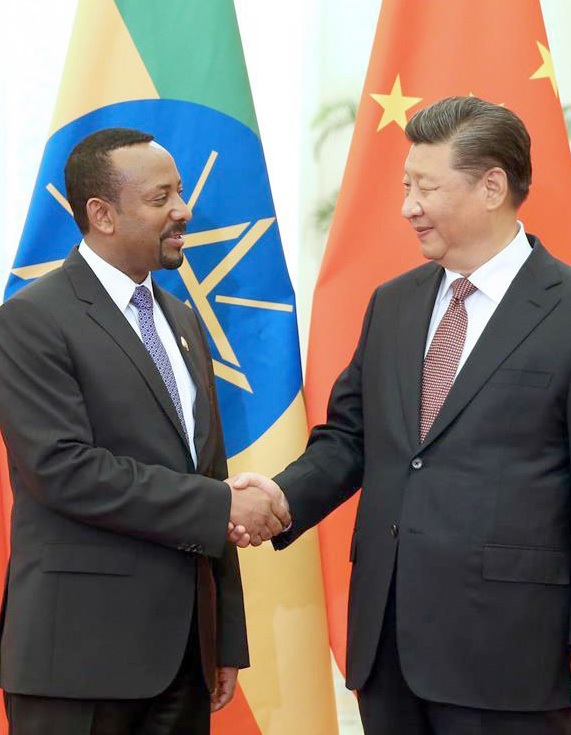

Praising Prime Minister Abiy Ahmed’s (PhD) meticulous approach in convincing Chinese leadership to fully cancel Ethiopia’s interest free loans matured till end of last year, economic experts are calling for long-term approach to curtail the growing public indebtedness.

Ethiopian high-level delegation led by Premier Abiy attended Belt and Road Forum for International Cooperation in Beijing last week and signed various business and investment agreements and reached consensus with Chinese Government to null interest free loans Ethiopia had to pay till the end of 2018.

Speaking to The Ethiopian Herald, Research Officer at Ethiopia’s Development Bank, Kurabachew Menber (PhD) says that the loan cancelation package has a paramount importance in enabling Ethiopia to channel the foreign exchange to enhance the overall performance of the economy and ensure the speedy completion of mega projects from loan repayments.

Kurabachew states that the debt relief is also beneficial to Ethiopia to stimulate its economic growth that was partly slow down by the recent unrest in parts of the country and to nurture domestic and foreign investments.

“Due to the unrest, development projects which the country commenced on foreign loans have not generated significant returns thereby causing reschedules of loan repayments and increasing public indebtedness.” Premier Abiy’s deliberations with

Chinese leadership in Belt and Road Forum have been so successful in lessening the huge debt burden Ethiopia’s economy has been encountering.

The expert further says that the loan cancellation showcased China’s firm commitment to support Ethiopia’s development efforts while expressing optimism that it is a good gesture to ensure flow of more Chinese investment to Ethiopia.

Similarly, Economics Assistant Professor at Dila University Tasew Tadesse (PhD) says that the debt relief would have significant importance to supplement Ethiopia’s foreign-exchange reserves and plays its own role in addressing the chronic forex crunch.

Noting Ethiopia’s huge indebtedness hampering government’s poverty eradication efforts, the expert indicates that the debt relief package enables the incumbent to allocate substantial finance to the establishment and expansion of education, health and other social services across the country.

Tasew states that the debt cancelation is vital to the Ethiopian government to address the gaps in infrastructural connectivity and enhance the quality and provision of utilities hence boosting productivity and creating more jobs. The move has also equal importance to encourage foreign companies to involve in Ethiopia’s market.

According to the Assistant Professor, the debt relief is essential for the ongoing political and economic reforms and plays its own share in supporting government’s efforts to bring in macroeconomic stability.

Both experts, however, agree that debt cancellation, negotiation and diplomatic efforts give short term relief for Ethiopia’s economy and the country should seek long-term solution to overcome the debt trap.

According to Tasew, the prime allocation of foreign loans to mega projects and national infrastructural development slows the returning of debts and increases public indebtedness as the structures need too much time and are dependent of other variables to generate the desirable finance. Due to the past unrest and the widespread maladministration, most of the mega projects have faced construction delays and requiring additional finance.

Over expansion of public expenditure, ineffective allocation of budget for intended purposes as well as overheated economic growth contribute for Ethiopia’s enormous public debt.

As to Kurabcahew, the unsatisfactory export sector performance and limited domestic resource mobilization enforce the country relies on foreign borrowing and the extended debt repayments deplete the hardly-gained foreign currency that would rather meant to sustain the economic growth.

To overcome the challenge, the expert states that the government should ensure the proper utilization of loans for targeted purposes and a timely completion of mega projects and infrastructural developments. Bolstering government’s tax collection capacity and Inland Revenue is also instruments to lessen Ethiopia’s dependence on foreign borrowing.

According to Tasew, diversifying portion of the loan to build industry development is beneficial to create more jobs and additional income for citizens thereby increasing government’s domestic revenue and reducing the pace of loan queries.

According to him, the government needs to capitalize on diplomatic channels to get debt relief and debt cancelation and initiate bilateral and multilateral negotiations with major lending countries and organizations including China.

Noting 60 percent of Ethiopia’s GDP is public debt, both experts express conviction that minimizing public expenditure and ensuring the private sector’s access to loan are crucial steps to reduce Ethiopia’s reliance on foreign borrowing; while they call for a stricter mechanism to control capital flight. The East Asian country was by far Ethiopia’s major lending country constituted 12 billion USD from the latter’s total 26.4 billion USD foreign debts in 2018, according to Ministry of Finance.

They say that transforming the existing commodity dependent export sector to industrial products and directing the huge remittance to formal channels as well as creating a favorable business climate and conserving and promoting tourism potentials would effectively curb Ethiopia’s level of indebtedness.

The Ethiopian Herald April 30/2019

BY BILAL DERSO