Private equity is an important force in financial markets. Due to its dynamic nature, private equity can transform businesses and communities in developing economies, and thereby help bring about sustainable development in countries. However, this has not been the case so far. A recent report reads that while private equity accounts for about 200 billion USD in investment worldwide each year, only 10 percent of it reaches emerging markets.

Nevertheless, developing countries, aware of its dynamic potential, have been striving to get bite of the pie, and use it as a vehicle for sustainable growth of the private sector in their economies.

Ethiopia, for its part, has been working to make use of its rapidly expanding economy. And the outcome has been positive as private equity activity has increased in the last decade, with more and more funds backing local businesses and setting up shop in the country. Ethiopia has risen to be an attractive investment destination driven by the relatively high economic growth rate.

And recently, Ministry of Finance stated that it is planning to expand private equity approaches in an aim to ensure the development is comprehensive.

State Ministry Finance Dr. Eyob Tekalign noted that various efforts are underway to expand private equity. The government along with the relevant stakeholders is working to revise, regulations, the commercial codes and related laws to nurture healthy development of private equity. It is also working to create informed business community that could partake in private equity business,” he noted.

Private equity investment in Ethiopia focuses on three sectors: consumer goods, agribusiness and telecommunications, and the government is working to expand into other sectors and the future green.

For instance, the recently concluded 5th East African Private Equity and Venture Capital Association conference indicated that investors are looking market opportunities in Ethiopia.

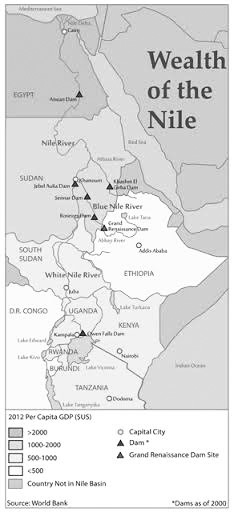

This happened because Ethiopia is among the worlds’ fastest growing economies recording GDP growth entering double digits in 2017 and the forecast to remain above seven percent between 2018 and 2020, according to IMF figures.

High growth has outpaced the ability of local banks to meet the financing needs of the private sector, creating further space for private equity (PE) investments as the economy opens. Because the incumbent is certain it is influential approach to nurture progressive and stable growth. Though the rate of private equity activity in the country is low, accounting for less than 10 percent of the 51 disclosed deals in 2018 after recording no deals in 2017 the future is green.

Ethiopia Investment Commission Commissioner, Abebe Abebayehu also noted that Ethiopia striving to be one of the investment destinations opening to foreign investment and putting various incentives.

A number of industrial parks facilities ranging from agro-processing to apparel, ICT and pharmaceuticals are opened in various parts of the nation ushering renowned brands.

The government is looking to work with all entities of investors that are willing to come here and invest.

According to him, pertinent stakes are working to address the gaps expanding private equity, and actualizing the practices in the business system and framing clear accountability among the business runners the Commission holds. It is instrumental in ensuring progressive development across the nation, he argued.

Generally speaking, Ethiopia has so far understood the potential private equity can have in helping bring socio-economic development and changes. Not only has the country benefited from private equity activity with many companies being owned by private equity firms, but strategic players are demonstrating appetite for Ethiopian investments due to its enormous opportunity for private equity investors.

And given the country’s ongoing reforms which are aimed at promoting a growing private sector, and in order to overcome the countries financial challenges, it is important to expand private equity investment – after all, Ethiopia’s enormous potential for private equity investment makes it prominent private capital destination.

THE ETHIOPIAN HERALD June 19, 2019

BY MENGISTEAB TESHOME &

ROBEL YOHANNES