Ease of doing business has various parameters and among others, the availability of stable macro economy such as manageable inflation rate, suitable interest rate, unemployment rate which goes in line with the economic growth.

Solomon Zegeye is an economist working as a consultant for various companies. As to him, when there is conducive doing business environment both domestic and foreign companies show interest to invest their money in business. For example, when a business man/woman wants to start business, he/she needs the licensing procedures shortened as much as possible. He/she also wants to acquire investment permission with no bureaucratic hurdle. The cost of doing business also matters and if it is exaggeratedly expensive, no investor shows interest to involve in the business.

Besides, investors need to make sure whether they get loan access from banks and the availability of water and electric power along with access to get land ahead of allocating budget to incept a business.

Moreover, foreign investors evaluate the business environment whether it goes in line with the international standard or not. On the other hand, for the creation of enabling environment the mushrooming of strong institutions is vital, he said.

Easily mobilizing and getting domestic market to sell products in fair price is also one of the investors’ criteria. The production and consumption system prevailed in the country also must be healthy. However, as to Solomon, the monopoly of the market by few individuals witnessed in the country is not appealing to other investors. By the same token, the inefficiency of public institutions forces investors to show reluctance in engaging to business.

According to the document from the Office of the Prime Minister, improving the ease of doing business is an integral part of the national economic competitiveness and job creation agenda. It advances entrepreneurship and new startups and formalizes businesses. It also encourages competitiveness and productivity of local businesses. It also encourages investment attraction and retention. It supports more and better jobs creation; transparency and accountability in public service delivery; efficient tax administration and to collect domestic revenue.

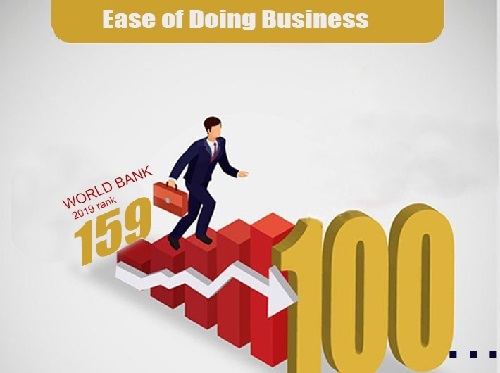

According to the document, the government in easing doing business forwarded short-term reforms which highlight the venue to achieve the goal. To this end, five new laws and forty procedural and administrative reforms were enacted. Having high-level reform leadership at PMO and in each Ministries; clearly defined reform agenda and regular progress tracking mechanism helped to drive the reform agenda. Short term reforms focused on quick wins laying the ground for a more ambitious medium-and long-term reforms.

Reforms need to be fully implemented as verified by the private sector to have an impact on Doing Business (DB) ranking.

Among the reform achievements are starting business in a speedy manner, indicating company name and the amount of capital and employing capacity.

Amid the pre-requisites for ease of doing business is creating legal base for the application of software replacing cash register machine. Besides, getting credit directive which includes Ministry of Finance and leasing companies in to NBE credit registry system; adopting credit information system coverage which includes both private and public Banks are among the requirements. Proclamation is also endorsed on ensuring movable properties security rights.

Trading across boarder and electronic single window system piloted deferred payment; pre-arrival and advance ruling implemented. Number of documents required for import reduced by 10 to 12 percent for export and 9 to 11 percent for import. Risk level for both import and export improved reducing the need for physical inspection and e-certificate of origin also implemented.

Paying taxfilling and e-payment on gradual expansion for large tax payers and the number reached to 2,800 with e-filling. Tax payment through banks implemented dedicated to medium tax payers branch opened in Addis Ababa. Risk-based VAT refund system also introduced.

According to the World Bank, ease of doing business is about freedom to do business. It aims to prevent workers mistreatment by greedy employers, improving labor market, regulation of public procurement, and to protect shareholders’ investments.

However, as to the report, regulation misses its goal, poor efficiency leads to another, especially in the form of government overreach in business activity. Governments in many economies adopt or maintain regulation that burdens entrepreneurs. Whether by intent or ignorance, such regulation limits entrepreneurs’ ability to freely operate a private business. As a result, entrepreneurs’ resort to informal activity, away from the oversight of regulators and tax collectors, or seek opportunities abroad—or join the ranks of the unemployed. Foreign investors avoid economies that use regulation to manipulate the private sector. By documenting changes in regulation in 12 areas of business activity in 190 economies, Doing Business analyzes regulation that encourages efficiency and supports freedom to do business.

The data collected by Easing Doing Business address three questions about government. First, when do governments change regulation with a view to develop their private sector; second, what are the characteristics of reformist governments, and third, what are the effects of regulatory change on different aspects of economic or investment activity. Answering these questions adds to the knowledge of ease of doing business.

With these objectives at hand, doing business measures the processes for business incorporation, getting a building permit, obtaining an electricity connection, transferring property, getting access to credit, protecting minority investors, paying taxes, engaging in international trade, enforcing contracts, and resolving insolvency. Easing Doing Business also includes collecting and publishing data on regulation of employment as well as contracting with the government.

The employing workers indicator set measures regulation in the areas of hiring, working hours, and redundancy. Contracting with the government indicators captures the time and procedures involved in a standardized public procurement in a transparent manner. These two indicator sets do not constitute part of the ease of doing business ranking. Research demonstrates a causal relationship between economic freedom and growth of Gross Domestic Product (GDP), where freedom regarding wages and prices, property rights, and licensing requirements leads to economic development. Of the 190 economies measured by Doing Business in 2020, land registries in 146 countries shows lack full geographic coverage of privately owned land.

All privately held land plots are formally registered in only 3 percent of low-income economies. Overall, on the registering property indicator set, 92 economies receive a score of zero on the geographic coverage of privately owned land index, 12 on the transparency of information index, and 31 on the reliability of infrastructure index. Globally, property registration processes remain most inefficient in the South Asia and Sub-Saharan Africa regions. Easing doing business in 2020 shows that effectiveness of trading across borders also varies significantly from economy to economy.

BY ABEBE WOLDEGIORGIS

THE ETHIOPIAN HERALD OCTOBER 1/2021