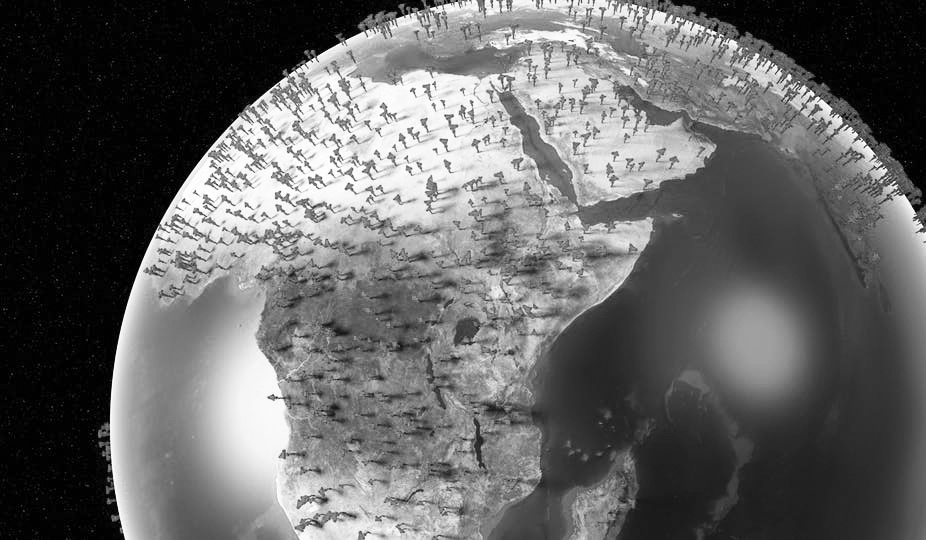

The panic resulting from the events starting with the deaths in Wuhan keeps spreading globally faster than the spreading of the virus itself. Quite apart from the immediate health dangers, now a new economic danger looms large globally. We are facing the prospects of a deep and lasting global recession regardless of the health policy and economic policy measures taken by China, the U.S. and other countries unless there is timely global cooperation and coordination. What will be the global economic impact of COVID-19 if swift and effective action is not taken globally? Is there a way to find out through some kind of rigorous model-based economic analysis?

Indeed there may be a sober reality-based way of looking at the possible economic consequences. In work that is still ongoing, I have used the best available data from the World Bank, the IMF and other national and international sources about the Global Economy to do precisely this exercise. My preliminary results pertain to the overall effects for the World economy, China, the U.S., the Middle East as well as for specific sectors. More importantly, they also give us some rough insights into what the panic might mean for the major regions unless we take effective global action quickly.

In order to assess the impact, I have derived several sets of model-based counterfactual results. My work which is ongoing can be seen as a first step in analyzing the impact of COVID-19 rigorously. Aggregate consequences for the Global, Middle-Eastern (ME), EU and U.S. economies in terms of output and employment losses are estimated from several models for several scenarios. These are both the containment costs and costs stemming from global panic with higher and lower bounds and an in-between scenario. Finally, a more complex economic systems model with explicit banking and financial sectors is used to analyze the financial systems scenarios.

It is clear that China will suffer the most. But so will Japan, the Middle East, the U.S. and EU economies along with many other smaller economies. Hence there is no reason for the rivals of China to rejoice. With maximal containment costs and panic, Chinese GDP will decline by several percentage points. EU will lose about two percentage points and U.S. about between one and one and a half per cent. But some of the model results already at hand should give thoughtful ME, U.S. and EU citizens pause. With declining oil prices, the oil producing economies are already experiencing economic downturns. The direct and indirect effects of COVID-19 will worsen this trend.

As a first approximation, my current modeling results show that the easing of monetary policy and implementing expansionary fiscal policies – even if they are imposed immediately and coordinated globally – will take about six months to kick in and will lead towards the very low loss scenario, especially for China. But for EU and the U.S. financial firms, the loss will be considerably more than what we have seen so far. The corresponding loss in global employment in these and other sectors should also give all countries pause.

While medical and public health professionals struggle to understand the nature of the virus and devise antidotes, strong economic measures need to take globally and within countries to protect vulnerable groups. A coordinated interest rate cut will most probably happen; but monetary policy cannot by itself help increase global investment and output. Tax cuts will help but will take time even if they are wisely designed to help not just the global rich but the middle class and the low income groups. Fiscal policies through direct government expenditures targeted to specific sectors and groups will be necessary.

Furthermore, trade policies are important too. If trade barriers go up because of this panic reinforcing earlier hostilities then all countries will be losers. The hostilities against China may well be heading in that direction. Likewise, some countries might try to counteract the loss in exports by devaluing their currencies. Such moves can rapidly expand through the international system creating a competitive devaluations scenario where no one will ultimately win.

Consider also the role that trading networks have always played. Clearly, with globalization these networks of firms across the globe are even more important than before. With a large scale disruption the dynamics of network trade may easily break down. Since networks require time to build up again, such large scale disruptions will result in longer term malfunction of the global trading system.

The world leaders must act quickly and resolutely before it is too late. We are facing the possibility of a vicious downward cycle in the global economy. Single countries can act and indeed have acted unilaterally, for example the U.S. by cutting interest rates citing an emergency situation. But global coordination of monetary, fiscal, trade and exchange rates policies is sorely needed. If there was ever a time to devise globally coordinated policies through cooperation among U.S. and China (G 2), the G7 and more broadly, the G20, it is now.

The Ethiopian Herald March 31/2020

BY HAIDER A. KHAN